Blog

23 august 2018

September trends: the resolution of the cryptocurrency drama is nearby

While bitcoin continued its multi-month flat movement, the altocoinhodlers

experienced a real hell in August. Next month, there is a high probability to see

the resolution of drama, followed by a significant correction. Let's talk about

the precursors of the reversal.

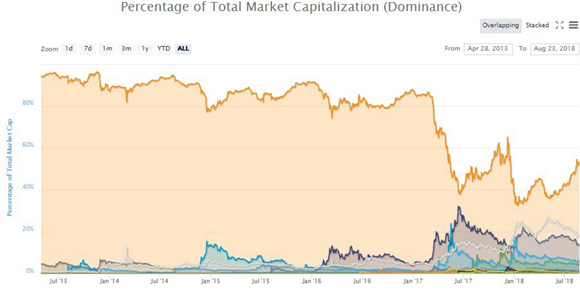

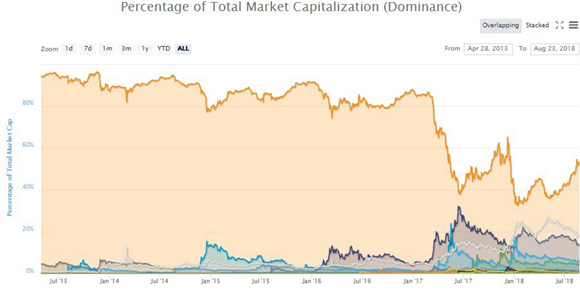

Hodlers of altcoins such as ether and EOS as well as the coins of the second and third

divisions, witnessed an "altocid", which crippled lots of accounts of the hodlers. At the same

time, the dominant position of bitcoin in capitalization continued to strengthen and reached

a record for 8 months and firmly entrenched above the 50% mark.

Almost everything collapsed. The main news reason for this was the postponement of the SEC decision on the first regulated crypto-currency ETF. However, bitcoin was less affected by this predicted hitch and key levels of support for buyers were retained. That can not be said about the altcoins, which synchronously updated the annual minimums. This behavior is evidence of the current weakness of the market, the inflow of funds is not enough for everyone, the main inflows are directed to the most fundamentally strong coin. Not everything is smooth concerning the release of finished products by the altcoins teams. According to investinblockchain.com, 60 out of the top 100 coins in terms of capitalization still do not have a working product, despite the capitalization of tens of millions. Judging by the experience of the dotcom bubble in the US, even a smaller percentage of them will be able to present a commercially successful product, and it may take several years to restore the market to previous levels. However, despair is not necessary, because the capitalization of the Nasdaq composite after the crisis of 2000-2001 has grown by an order of magnitude, and some of the most successful companies have risen in price in hundreds of times. The use of portfolio investment principles will sharply increase the chances of buying a "new Amazon" in this situation.

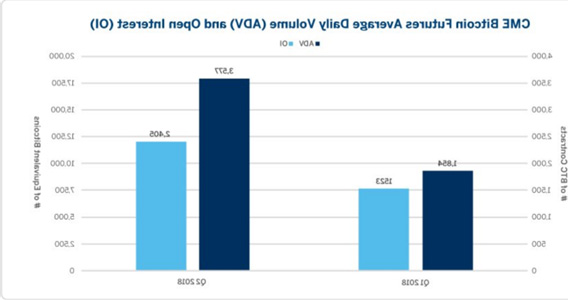

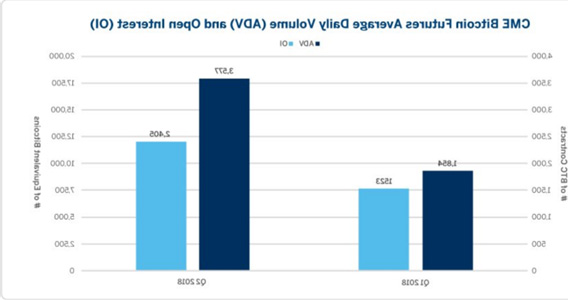

It is still early to talk about the beginning of the global market reversal, however, a strong correction is quite anticipated, both from the perspective of technical analysis and also taking into account indirect signs. Let's note some interesting moments: The data from SimilarWeb indicate the stabilization of audience interest in crypto-currencies for the first time since the beginning of the year. The traffic of the main trading and information services ceased to fall. Google trends confirm the stabilization of interest; More and more money come into the market from investors of the US stock market. According to CME, trading volumes and the number of open contacts for bitcoin are growing at an impressive rate;

Activity in the Bitcoin network is close to its six months highs. However, those wishing to buy should be careful. Before the reversal, it is likely that large players will try to break through the $ 6000 level in order to update the year lows somewhere around the $ 5500 mark where the border of the descending channel passes. You do not need to be an oracle to predict how the altcoins will behave.

Buying is preferable only after a false breakdown of the $6000 level is confirmed and the price will return into the previous range. In case there will be growth without a breakdown of new lows, you can focus on the daily close above the fifty-day moving average. Growth usually begins with the most fundamentally strong positions. In the US stock market, this may be the shares of Internet giants. In our case, it is bitcoin, the dominance of which is likely to remain at a high level in the next few months. The reasons for this trend will be discussed in more details in one of the following reviews. As for the technical picture in altcoins, the situation with the ether falling within the descending channel is representative. Indicators indicate oversold, but it is not the best tactic to hurry with purchases. You should be patient and wait for the break-out of the channel, or at least the overcoming of the previous high at $315.

Back to Blog

Almost everything collapsed. The main news reason for this was the postponement of the SEC decision on the first regulated crypto-currency ETF. However, bitcoin was less affected by this predicted hitch and key levels of support for buyers were retained. That can not be said about the altcoins, which synchronously updated the annual minimums. This behavior is evidence of the current weakness of the market, the inflow of funds is not enough for everyone, the main inflows are directed to the most fundamentally strong coin. Not everything is smooth concerning the release of finished products by the altcoins teams. According to investinblockchain.com, 60 out of the top 100 coins in terms of capitalization still do not have a working product, despite the capitalization of tens of millions. Judging by the experience of the dotcom bubble in the US, even a smaller percentage of them will be able to present a commercially successful product, and it may take several years to restore the market to previous levels. However, despair is not necessary, because the capitalization of the Nasdaq composite after the crisis of 2000-2001 has grown by an order of magnitude, and some of the most successful companies have risen in price in hundreds of times. The use of portfolio investment principles will sharply increase the chances of buying a "new Amazon" in this situation.

It is still early to talk about the beginning of the global market reversal, however, a strong correction is quite anticipated, both from the perspective of technical analysis and also taking into account indirect signs. Let's note some interesting moments: The data from SimilarWeb indicate the stabilization of audience interest in crypto-currencies for the first time since the beginning of the year. The traffic of the main trading and information services ceased to fall. Google trends confirm the stabilization of interest; More and more money come into the market from investors of the US stock market. According to CME, trading volumes and the number of open contacts for bitcoin are growing at an impressive rate;

Activity in the Bitcoin network is close to its six months highs. However, those wishing to buy should be careful. Before the reversal, it is likely that large players will try to break through the $ 6000 level in order to update the year lows somewhere around the $ 5500 mark where the border of the descending channel passes. You do not need to be an oracle to predict how the altcoins will behave.

Buying is preferable only after a false breakdown of the $6000 level is confirmed and the price will return into the previous range. In case there will be growth without a breakdown of new lows, you can focus on the daily close above the fifty-day moving average. Growth usually begins with the most fundamentally strong positions. In the US stock market, this may be the shares of Internet giants. In our case, it is bitcoin, the dominance of which is likely to remain at a high level in the next few months. The reasons for this trend will be discussed in more details in one of the following reviews. As for the technical picture in altcoins, the situation with the ether falling within the descending channel is representative. Indicators indicate oversold, but it is not the best tactic to hurry with purchases. You should be patient and wait for the break-out of the channel, or at least the overcoming of the previous high at $315.

Related articles

1 december 2018

ECR.Money: Announcement of 2019 Roadmap

ECR.money, the cryptocurrency and

merchant-focused payment processor, is excited to announce the publication of its 2019-2020

roadmap.

Read more

12 november 2018

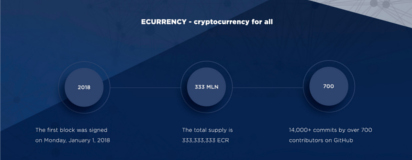

ECURRENCY⭐ Free, decentralized digital form of payment

We published the announcement of our cryptocurrency at

https://bitcointalk.org/

Read more